NEW YORK, NY (October 12, 2018) - A decade after the market crash of 2008, the world of small business loans is thriving. Approval rates are rising at community banks: 49.8% of funding requests were granted in 2018.

American Companies No Longer Dominate Global Venture Capital Investments

Image courtesy of the Center for American Entrepreneurship

WASHINGTON, DC (October 11, 2018) - American businesses’ share of global venture capital funding has declined from 95% in the 1990s to 50% today, and is continuing to diminish quickly.

China’s share is growing fastest, reaching nearly 25% of the global total in 2018. Thailand has also become a leader, seeing nearly 600% growth.

While Asia’s growth is skyrocketing, the US continues to thrive and break records. American companies received more venture capital investments in the first six months of 2018 as they did in the past ten years total, according to PitchBook.

Louisiana Small Businesses Received $328 Million in SBA Loans in 2018

BATON ROUGE, LA (October 10, 2018) - Approximately 500 small businesses in Louisiana receive $328 million in small business loans from the Small Business Administration (SBA) in 2018, according to a recent SBA report. The report determined that this was an increase of 69% in dollars and 29% in loans since 2017.

“As I say at every opportunity, I am grateful to all our lending partners who value and use SBA guarantees to extend much-needed growth capital to Louisiana small businesses,” said SBA District Director Michael Ricks. “Our increase in lending this year is in large part due to our lending partners’ dedication to lending to the small business community.”

FDIC: Community Banks Fund 42% of Small Business Loans

ATLANTA, GA (October 9, 2018) - Local banks hold 42% of all small business loans in the United States, a new study by the Federal Deposit Insurance Corporation (FDIC) found.

“Small businesses comprise almost half of private-sector employment in the United States, and banks are the most common source of external credit for these businesses. Despite holding only 13% of banking industry assets, our data shows that community banks hold 42% of small business loans,” FDIC Chairman Jelena McWilliams said. “In light of ongoing consolidation in the banking industry, banks’ ability to meet the credit needs of this important sector is of vital interest to the FDIC.”

Venture Capital Limited by Geography, Race and Gender in 2017

BOSTON, MA (October 1, 2018) - Fewer than 10% of venture capital-backed startups had a female co-founder, and fewer than 1% had an African-American female cofounder in 2017, according to a recent report by Pitchbook. The study also determined that 75% of all venture capital went to companies in California, Massachusetts and New York.

Increasing access to venture capital is imperative in 2018, to empower and maximize the potential and impact of entrepreneurs of all genders and races throughout the United States.

Despite the lack of venture capital funding, companies with a woman on the founding team outperformed all-male companies by 63% in a ten-year study by First Round Capital. Racially diverse companies outperformed industry norms by 35%, according to a McKinsey study.

Small Businesses Booming in Rhode Island

PROVIDENCE, RI (September 26, 2018) - The state of Rhode Island invested in numerous small business development and funding programs and is enjoying a subsequent boom in small businesses and startups.

The state government recently launched a small business funding program providing capital to 125 new businesses, as well as initiatives to help new and existing businesses on product development, research and recruiting new talent.

“Providence seemed like a place where people could really follow their passions and open the store of their dreams,” said Emma Ramadan, owner of Riffraff Bookstore and Bar. “Every person we turned to for help or assistance, whether in government or the small business association or our lender, helped us so much along the way.”

Community Bank Lending to Small Businesses is Increasing

WASHINGTON, DC (September 19, 2018) - Community bank lending to small businesses grew by 5% from 2010 to 2017, and total business loans grew 11% from $689 billion in 2010 to $765 billion in 2017, the US Government Accountability Office reports.

“Community banks — generally small and locally focused institutions — are important sources of credit to small businesses,” the report said.

Businesses Pursue Loans Before Federal Reserve Boosts Interest Rates

WASHINGTON, DC (August 30, 2018) - Federal Reserve interests rates are projected to rise from 2% to 3.1% by the end of 2019, indicating that the longer businesses delay to secure loans, the higher the interest rate they will pay.

“Business owners continue to invest in their firms and are finding success in securing capital, according to our latest figures,” CEO Rohit Arora says. “Smaller banks are a good source of capital for startups and companies with less than stellar credit rating.”

SBA Awards $150,000 FAST Award to Wyoming SBDC

JACKSON HOLE, WY (August 22, 2018) - The US Small Business Administration has named the Wyoming Small Business Development Center as a recipient of the Federal and State Technology (FAST) Partnership Program award.

“FAST partners are an important part of the innovation entrepreneur ecosystem. They provide training, financial and technical assistance for small, next-generation technology businesses, and help them navigate federally-funded innovation and R&D programs,” said Linda McMahon of the SBA.

Delaware Founders Initiative Mentors Startups and Entrepreneurs

DOVER, DE (August 20, 2018) - The new Delaware Founders Initiative is supporting innovation and entrepreneurship in Delaware, providing business development and mentorship services to startups and new entrepreneurs.

“We’ve worked with 46 entrepreneurs’ over our three-year history, and we’re continuing to seek out and to help Delaware’s risk-takers get off the ground to help rebuild our state, turning it into a destination for ideas, innovation and industry once more,” member Bill Topkis said.

Salt Lake City Has Highest Concentration of Young Business Owners in US

SALT LAKE CITY, UT (August 16, 2018) - Salt Lake City, Utah has the greatest concentration of young entrepreneurs in the United States, a new study cited in Fox Business found.

The city’s low cost of living and youthful population make it an ideal base for establishing a business.

Tech Partnerships a Major Success for African-American Bank in South Carolina

COLUMBIA, SC (August 15, 2018) - South Carolina Community Bank rebounded from the financial crisis by developing a new network of Fintech partnerships.

“As a small bank, we don’t have a large innovation lab budget; we don’t have the thousands of people focused on product development that large banks have,” CEO Dominik Mjartan said. “But we do have some very good partners we’re working with that could really transform our ability to innovate and then scale the innovation.”

South Dakota, Tennessee, Alaska, Michigan and Utah Rank Highest for Supporting Small Businesses

SIOUX FALLS, SD (August 14, 2018) - The states of South Dakota, Tennessee, Alaska, Michigan and Utah rank highest for being friendly and supportive to small business owners, according to a new national survey of 7,500 business owners.

Montana #1 in US for Entrepreneurship

Source: Montana Public Radio

HELENA, MT (August 7, 2018) - Montana leads the United States in entrepreneurship, according to a new study by the Bureau of Business and Economic Research at the University of Montana.

More than ten percent of Montanans own a business as their primary job, compared to the national average of six percent. Approximately 3,400 Montanans launch a new business every month, and more than half of all businesses opened in 2011 were still open five years later.

"Industries wax and wane. The entrepreneur's job is to kind of say, ‘Oh hey, that industry over there is on a downturn. That means there's some capacity that’s going un-utilized here. Let me see if I can figure out how use that to do something else,” said researcher Bruce Ward. "We create a lot of seeds, those seeds germinate and tend to survive."

Vermont Sees Growth from Investing in Local Businesses

VERGENNES, VT (August 6, 2018) - The previously quiet town of Vergennes, Vermont has seen a boom in new businesses since the town was declared an “opportunity zone”, encouraging investment in local businesses.

The program offers tax incentives to investors who fund businesses based in the zone. Vermont now has 17 opportunity zones that include 85,000 people and 7,000 local businesses.

"Now, this is a destination," business owner Jeannie Pelsue says. "We've got fabulous stores and people come from all over."

Small Business Employee Income Reaches New High

NASHVILLE, TENNESSEE (May 11, 2018) excerpt via CNBC - Small business workers saw their earnings grow at the highest rate in two years, according to a new Paychex report.

Hourly earnings increased by an annual rate of 3.25%, the study found. Among the 50 states, Tennessee placed first for small business job growth, and Arizona saw the highest hourly-wage growth.

"The low unemployment rate is contributing to steady increases in wage growth," Paychex CEO Martin Mucci wrote. "With tightening labor conditions and wages continuing to show positive momentum, business owners and HR managers will need to focus on recruitment and benefit strategies to attract and retain qualified talent."

Small Business Lending at an All-Time High in Georgia

AUGUSTA, GA (May 7, 2018) excerpt via THE AUGUSTA CHRONICLE - Small business lending is at an all-time high in Georgia, according to a report by the Georgia Small Business Administration.

The SBA reported that $1.41 billion was loaned to small businesses in Georgia in 2017. The state has nearly one million small businesses, which account for 44% of private sector jobs.

“The lending environment is much better than it was 10 years ago,” Drew Tonsmeire of the Small Business Development Center at Kennesaw State University told The Augusta Chronicle.

Florida Small Businesses Need Workers to Grow

TAMPA BAY, FL (April 28, 2018) excerpt via TAMPA BAY TIMES - Small businesses in Florida are growing but their top concern is finding skilled workers to hire, a Florida Chamber of Commerce study reports.

“Businesses continue to tell us that in order to expand and to be competitive, they need access to a talented workforce,” said Jerry Parrish, chief economist and director of research for the Florida Chamber Foundation.

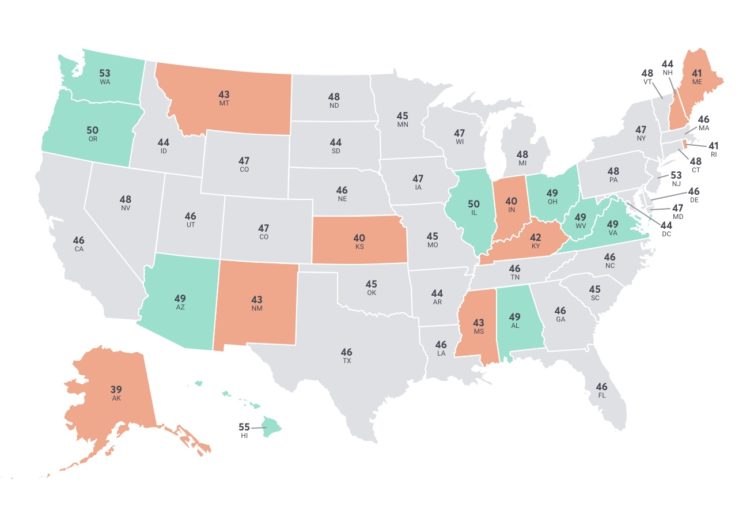

Hawaii Ranks #1 for States with Best Business Credit Scores

Photo Credit: Nav

HONOLULU, HI (April 24, 2018) excerpt via NAV - Hawaii has the highest average credit score of any state in the US, according to a new study.

The state averages 54.6 on the 1 to 100 scale used in business credit scoring. Washington, Illinois, Oregon, West Virginia, Arizona, Alabama, Ohio, Virginia and Michigan closely followed Hawaii in the rankings for top ten.

Small Business Plays Vital Role in West Virginia’s Economy

CLARKSBURG, WV (April 23, 2018) excerpt via WVNEWS - Small businesses are the backbone of West Virginia’s economy, accounting for 99% of all businesses in the state and employing half of the state’s private workforce, according to the Small Business Administration.

“Everybody thinks it would be so great if we had a factory come in that would employ 400 people, but it’s a lot better if you have 40 businesses that employ 10 people. You’ve got the same result, but you’ve got a much more diverse economy that’s better able to withstand downturns and problems that come along,” business owner Tom Hart said to WV News. “Small businesses are extremely, extremely important.”